[ad_1]

Mainland Chinese medium- and hefty-responsibility vans (MHDTs) have

entered a bear industry considering the fact that mid-2021. Despite the fact that the market place staged a

slight restoration following the easing of power shortages and

injection of policy stimulus from late last 12 months, unexpected

headwinds brought by the Russia-Ukraine crisis and domestic Omicron

outbreak plunged the industry again into weak point in the second

quarter of 2022. Amid pandemic-induced lockdowns in Jilin and

Shanghai, production of MHDT strike the lowest looking through for April around

a 10 years. In our Could forecast, we downgraded the mainland Chinese

MHDT manufacturing for 2022 by 5% to 1.13 million models, a drop of

23% in contrast with 2021.

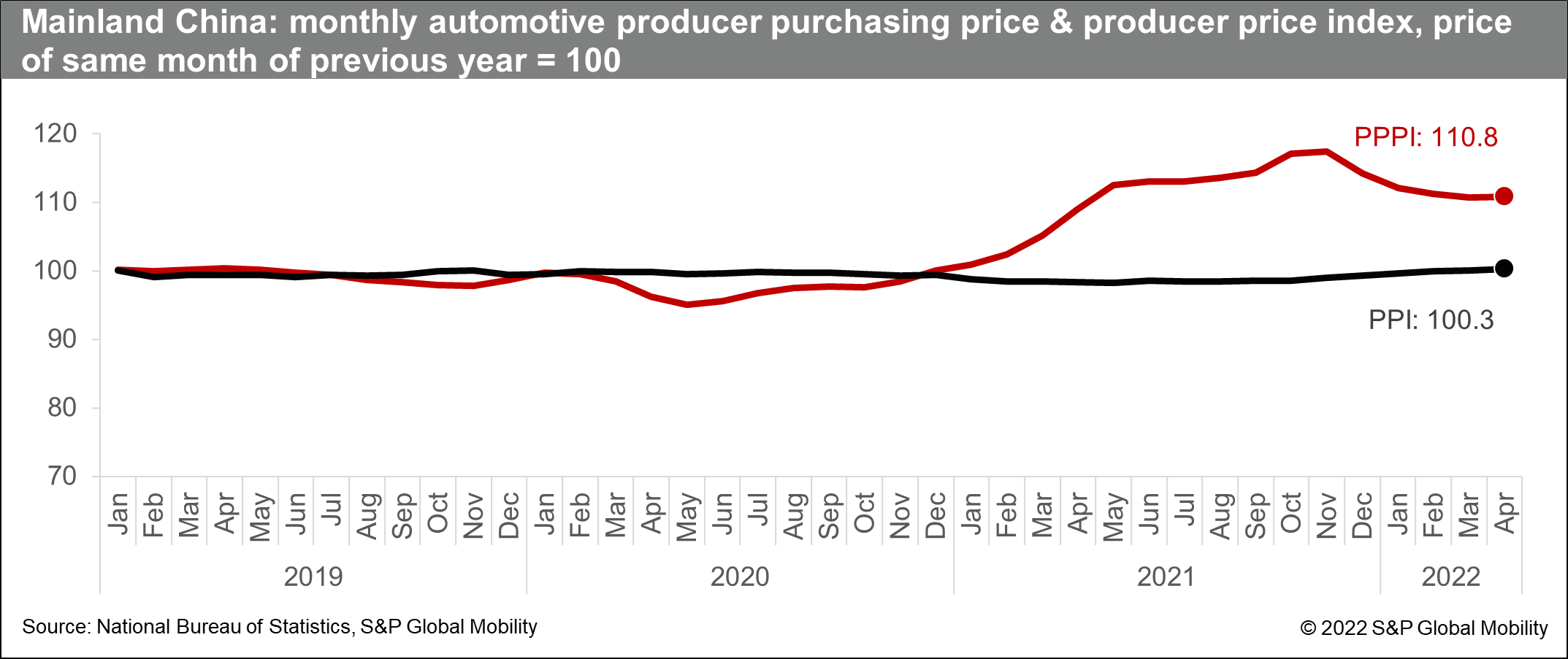

External geopolitical tensions generate up producer charges

As uncooked resources signify 20-30% of the value of manufacturing for

hefty trucks, uncooked content charges partially identify the

profitability of truck producers. Owing to the world-wide economic

restoration from the COVID-19 scare, commodity rates have

undergone an upcycle due to the fact late 2020. The rally gained additional steam

in the initial quarter of 2022 with the outbreak of the

Russia-Ukraine war. Exclusively, the cold-rolled metal selling price that

accounts for around 60% of the full raw substance fees for a weighty

truck surged by 3% in March 2022 from the degree of January,

expanding the growth to a lot more than 40% as when compared to the very same

interval of 2020. Also, the diesel selling price raised by 15% and handed the

RMB9,000 for each metric ton mark by way of January-March 2022. In

distinction, the movement of marketing costs for heavy vans had been

fairly flat less than slack desire, as gasoline price inflation elevated

the operating expenditures though oversupplied trucking constrained freight

price development. As a result, the truck producers’ buying and

providing costs logged considerable differentiation, even with an

boost in cost of CN6-amount styles. This sort of weak inflation

move-by way of influence has manufactured truck makers to bear the brunt of the

financial gain margin squeeze in particular following dumping of CN5-level vehicles.

With the Russia-Ukraine crisis expected to deepen into 2023,

brief-time period truck output is therefore lower by all around 25,000 units

in the Might outlook.

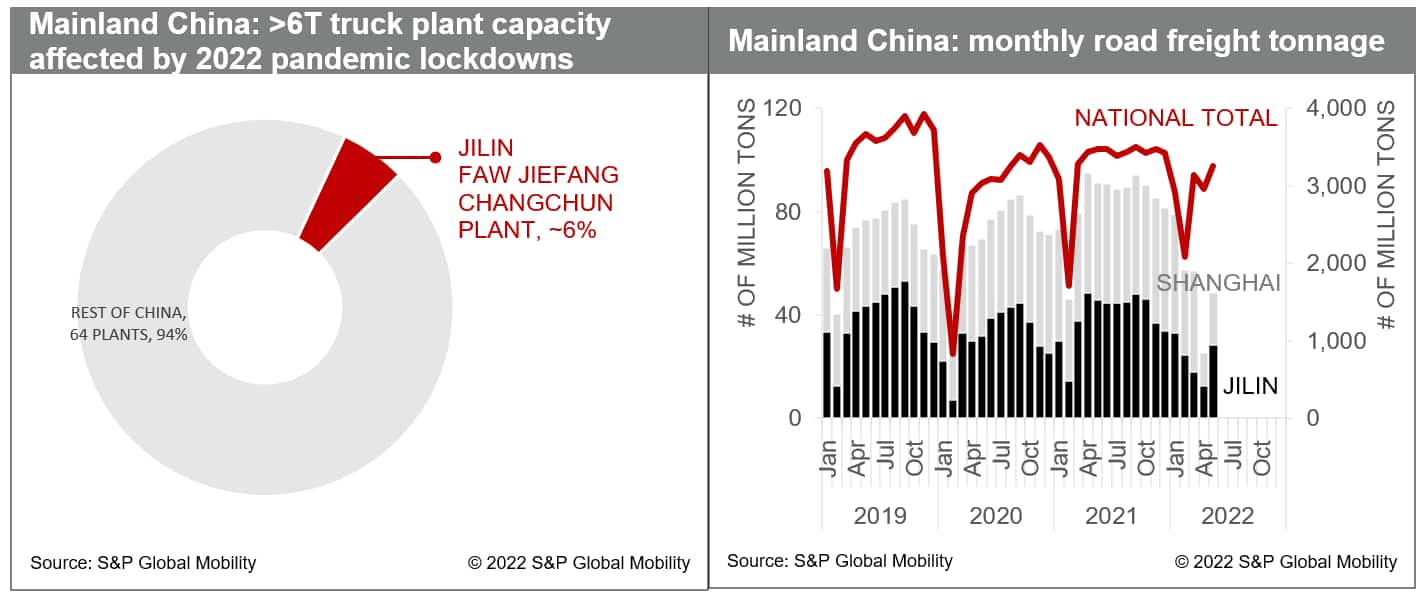

Inner pandemic resurgences exacerbate offer chain

disruptions

The Omicron wave experienced brought on large lockdowns in Jilin

Province (March 11-April 28), Shenzhen Metropolis (March 14-20), and

Shanghai Town (March 28-May well 31) since March 2022, resulting in

popular business disruptions and logistics snarls. Whilst

there are number of MHDT manufacturers in the epicenters of the pandemic,

Changchun Metropolis and Shanghai City host more than 40 massive supply bases

serving core factors to mainstream versions covering over 90% of

truck production. Setting up from mid-April, FAW Jiefang’s Changchun

plant and most suppliers managed to resume work in the closed-loop

procedure, but labor shortages below the mobility management disabled

them to perform at ordinary potential. In the meantime, rigorous

containment measures these kinds of as site visitors limits, nucleic acid

check and quarantine prerequisites, as very well as closure of toll

stations pent up road freight demand and triggered wider repercussions

of ingredient shortages, which in convert dampening truck production.

Underneath the situation, the full reduction of MHDT output in the

second quarter is estimated to reach 100,000 units. With ramping up

efforts to clean logistics and restore company, the operate

resumption level of enterprises over specified dimension in Shanghai

Metropolis improved to 96% by mid-June and will fully get better from July.

Coupled with expansionary guidelines and ample potential

reserves, these could assist MHDT output to choose up and offset

the pandemic-induced decline in the second 50 %.

A more downgrade to outlook is underneath assessment, as the

government’s reliance on the “dynamic zero-COVID” technique and

money outflows led by the Fed’s tightened cycle are most likely to

weaken enterprise sentiment and subdue desire restoration. On the other

hand, the rebuilding of vendor inventories of CN6-degree MHDTs

climbed from 280,000 units in early this calendar year to 380,000 models by

April, way increased than the standard premiums of 150,000-170,000 units.

On top of that, there ended up more than 70,000 models CN5-amount new

trucks (bought as applied vehicles) remaining in the sector, exacerbating

de-stocking pressures.

This post was revealed by S&P World Mobility and not by S&P World Rankings, which is a independently managed division of S&P World-wide.

[ad_2]

Resource website link

More Stories

Car Rental Tips Before Planning For a Vacation Trip

Why Is It A Good Idea To Hire A Limousine?

Looking To Become An Uber Driver? Here’s Why You Should Use A PCO Rental Service