[ad_1]

Aftersales departments have to have to be prepared for a significant transform to their small business product in the coming decades as plug-in automobile profits build a sophisticated environment with reduced upkeep and new competencies and devices essential.

Aftersales departments have to have to be prepared for a significant transform to their small business product in the coming decades as plug-in automobile profits build a sophisticated environment with reduced upkeep and new competencies and devices essential.

The United kingdom is established on a path to electrification as all new vehicle revenue changeover to zero emission technology by the 2035 deadline. Most franchised sellers are currently in the thick of it. They have invested in expert applications and teaching to cater for the provider, servicing and mend (SMR) requires of the electrical cars (EVs) currently on the street, as nicely as to adhere to the benchmarks envisioned of them by their maker partners.

ICDP affiliate director, France, Thomas Chieux is foremost research into projections for how EV gross sales will impact aftersales do the job across big European marketplaces. Factors involve estimated EV income prices as nicely as how ordinary once-a-year mileage impacts the aftersales parc flowing by means of to workshops.

ICDP is also wanting at additional mature plug-in car markets this sort of as in Norway. Norway now has a new battery electrical motor vehicle (BEV) market place that accounts for additional than 85% of new car or truck profits.

Chieux claims: “Our simulation expects there to be a mix of 22% BEVs in Uk dealers’ aftersales parc for zero-to-four-yr-old vehicles by 2030. We are expecting a 6% drop in aftersales earnings as a outcome of the penetration of EVs in the Uk.”

Chieux says this drop is not most likely as remarkable as may well be envisioned and when it is achievable revenues will fall additional in the future, he suggests that, importantly for workshops, “there is time to adapt”. 1 location Chieux urges dealers to analyze is tyres.

ICDP facts shows a 20% enhance in tyre usage for EVs in comparison with inner combustion engine (ICE) cars because of to the larger torque and in general bodyweight of motor vehicles major to increased have on. ICDP details from Germany exhibits revenues created by tyres on EVs have been almost as high as the revenues from basic servicing on the zero-to-fouryear-old EV market.

Chieux states: “Tyres is an space of terrific levels of competition, but it is a segment sellers should really be wondering about.”

Unique garages are looking at tens of thousands of lbs ., instead than hundreds of 1000’s, to be absolutely established up to company EVs, such as the price tag of applications and teaching. Private protective machines (PPE), basic more workshop equipment and insulated applications are needed to secure professionals from the significant-voltage programs in EVs.

Franchised sellers also have the extra value of installing a variety of charging points.

AM’s conversations with many resources display the fundamental investment decision in finishing routine servicing function for EVs can be as little as £6,000 for an independent garage. But, once again, education fees also require to be factored in.

AM’s conversations with many resources display the fundamental investment decision in finishing routine servicing function for EVs can be as little as £6,000 for an independent garage. But, once again, education fees also require to be factored in.

Quentin Le Hetet, the British isles standard supervisor at automotive aftermarket sector intelligence firm GiPA Uk, explained to AM: “Most franchised dealers will seem at return on financial commitment (ROI) and have a multi-calendar year plan for EV servicing, which includes recruitment and education.

“When we assume about equipment and financial investment, the biggest financial commitment definitely is using the time for the eyesight for EVs.

“This is what will make the difference. Currently being capable to have that vision and recruit and prepare accordingly is the most essential thing.”

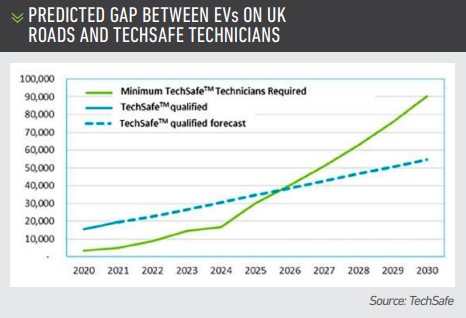

In accordance to the most up-to-date figures from the Institute of the Motor Business (IMI) only 11% of specialists in the British isles are qualified to do the job safely and securely on EVs. When this signifies a 4.5% increase on 2020, it nevertheless highlights the skills lack in the proportion of the automotive sector competent to perform on EVs.

IMI details figures forecast a shortfall of 25,100 experienced technicians and this could start off to effects the potential to fulfill EV servicing demand by 2027.

The IMI has called on the Govt to spend £15 million to assist fund training for 75,000 professionals to get them EV-all set. IMI chief executiveSteve Nash says: “It should be starting to be more and more apparent to even the best sceptic that the EV movement is now an inexorable development that they have to interact with if they want a sustainable company over and above 2030.

“With one-in-four new registrations now currently being electrified and EVs predicted to overtake ICE registrations by 2026/7, the economics of not participating with EV SMR turn out to be progressively questionable.”

Nash is urging independents to contemplate a step-by-action approach to EV investment decision. He suggests: “The expense doesn’t have to be substantial if taken in bite-sized steps and will make certain that they keep on being ‘in the game’, fairly than remaining powering.”

GiPA’s individual November 2021 customer survey of 420 British isles EV and plug-in hybrid motorists in charge of upkeep displays that 57% of them have been prompted to choose their automobile to a workshop they have not applied just before because of to trying to get specialist equipment and specialists.

EVs are developing a normal retention for franchised dealerships which are found as leading the way for specialist abilities. Le Hetet says: “There is some reluctance to spend in EV tooling from the impartial sector at this phase simply because they don’t anticipate to see EVs coming to them for a lot of years however.

“Customers are holding EVs longer in the franchised dealer system and so this is holding again publicity to impartial garages even additional.”

Le Hetet thinks it’s not likely workshops will be disposing of ICE specialist gear in their workshop ahead of 2040. He pointed out that diesel volumes only begun to ramp up from 2009 onwards and have dropped off given that Dieselgate in 2015, but the Uk aftersales auto parc will nevertheless have a lot of diesel employment to do for yrs to come.

Le Hetet thinks it’s not likely workshops will be disposing of ICE specialist gear in their workshop ahead of 2040. He pointed out that diesel volumes only begun to ramp up from 2009 onwards and have dropped off given that Dieselgate in 2015, but the Uk aftersales auto parc will nevertheless have a lot of diesel employment to do for yrs to come.

World wide technological know-how driveline and EV fluids manager at Castrol Paul Beasley says that, though there will be a alter in the blend and kinds of fluids, ICE routine maintenance and the gear expected by workshops will continue being extensive after 2030. The largest variation will be the continued reduction of motor oil sales as EV product sales maximize.

Nonetheless, EVs however need transmission and brake fluids, as very well as thermal management fluids and battery coolants, in addition EV-specific greases.

Beasley claims: “It’s still early days in conditions of the fluid lifecycle for EVs. The mix will transform and that will depend on the deployment of the various systems from OEMs.”

Castrol has been establishing new thermal management fluids that will have a bigger diploma of recyclability. So, it is possible new assortment and recycling approaches will require to be released. Beasley provides: “It will be shades of the very same. Transmission fluids on EV are really related to ICE, but the viscosity is thinner so it’s actually quicker to get them transferring in and out of the car and so time on the ramp is diminished.

“Much of the identical infrastructure for disposal will be the similar nevertheless.”

There is a greatly acknowledged watch that EVs are mechanically less difficult than ICE cars, which will most almost certainly reduce general services and maintenance specifications. Nevertheless, the development of new autonomous, connected, electric powered and shared (ACES) systems are producing autos much more intricate in other strategies.

Nash mentioned: “Taking a holistic perspective and ensuring that the workforce is correctly certified and equipped to appear immediately after all of these new and rising systems must nonetheless present workshops with plenty of commercial possibilities.”

Calibration, digital get the job done, examining updates and a better use of diagnostics will call for a lot more skills for specialists in the foreseeable future. Makers have quoted discounts of in between 30-40% on servicing for an EV compared with an ICE auto.

On the other hand, that hasn’t been the circumstance in exercise so much in accordance to Le Hetet.

Le Hetet stated: “We’re not viewing service pricing on EVs at a decreased charge for the franchised sector at the moment.

“Dealers might rate a diverse labour amount for EVs for the reason that it’s a new expense and there is new schooling. We’re nonetheless in the late choose-off stage so it’s also early to say how charges will settle.

“There are fewer components, but more checks, extra professional diagnostic operate and how this will be valued is what will set the current market for the coming years.”

[ad_2]

Resource url

More Stories

2022 Mercedes-EQ EQS Pros and Cons Review: The Very Endearing Blob

2022 Porsche Taycan 4 Cross Turismo Pros and Cons Review: Wag Swag?

How to Fix an Inflatable Water Slide: The Four Most Common Problems