[ad_1]

Sean Gallup/Getty Images News

I rate Google (NASDAQ:GOOGL) a buy due to continued growth within their cloud & search segments and significant future growth initiatives in their product pipeline. In 1Q22, YouTube Ad revenue experienced 14% y/y growth, missing consensus estimates by 7%. This drag in top-line growth can be attributed to fierce competition within the streaming space and Putin’s war in Ukraine.

Despite the top-line miss, management seemed optimistic about the opportunity that short-form video presents for Google. The company continues to see robust growth in engagement/time spent on YouTube, despite the return to in-person interaction. Additionally, there was a strong uptick in YouTube premium subscriptions.

Google continues to see strength in their core search revenue business, beating expectations despite the ongoing war in Ukraine. This points to resilient digital performance trends underlying the advertising market. Additionally, the Cloud continues to be a reliable source of revenue for tech companies. Google cloud was the key growth driver in 1Q22, generating revenue of $5.8 billion (up 44% y/y). The growth in these segments has led Google to authorize an additional $70 billion in buybacks of Class A and Class C shares.

YouTube Weakness Overblown

YouTube’s advertising revenue was negatively impacted by Google’s decision to suspend operations in Russia. Total revenue attributed to Russia in 1Q21 was primarily advertising, making up less than 1% of Google’s total revenue. The conflict could continue to drag on ad revenue for the next few quarters. Ad revenue was up 14% y/y, missing consensus analyst expectations by 7%. Other revenues from this segment were up 5%, reflecting subscriber growth in YouTube Music, Premium, and T.V. Google is still in the early steps of monetization of their YouTube segment, determining what price-points will optimize subscriber growth on the platform. Google is likely to increase prices in 2023 due to inflationary pressure.

Google’s YouTube might have had a rough quarter in YouTube ad revenue, but the company continues to see growth in other areas of the segment. Revenues from YouTube Music, Premium, and T.V were up 5% y/y in 1Q22. This growth was strongly offset in lower Play Store revenues attributed to pricing changes enacted on January 1st, where Google brought down subscription app store fee to 15% from 30%. This is likely to remain a drag on YouTube revenue through the next few quarters.

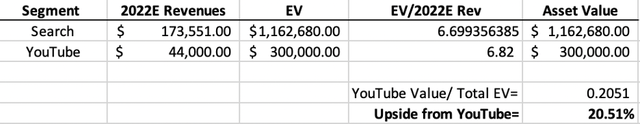

Despite headwinds, I still believe that YouTube is a highly valued operational asset, representing upside for investors on a standalone basis. Assuming 20% y/y growth to $44 Billion in YouTube revenues for FY22, my valuation model values YouTube at $299.2 billion using a 6.8x EV/2022E rev multiple. This implies that YouTube has 20.51% upside if it was traded on the NYSE on a standalone basis (see below).

Valuation/Upside of YouTube (Excel)

Search Revenues

Google’s search revenues for 1Q22 were up 24% y/y, beating wall street analyst estimates by 1%. Google’s search segment continues to be dependable, despite macroeconomic headwinds. This segment is the largest driver of advertising revenue due to positive trends in retail and travel. As the world continues to normalize from the pandemic, these positive trends should continue and bolster Google’s search revenue growth. Additionally, management noted that travel search in 1Q22 was above pre-pandemic levels in 2019 with query growth for vacation rentals up 37% y/y. This growth has benefited companies such as Airbnb (ABNB), illustrated by the lodging company’s strong earnings report this past week.

Cloud Revenues

The cloud industry continues to be a reliable source of growth for tech companies. Google Cloud revenue was up 44% y/y, slightly ahead of analyst estimates. This segment has ample room for margin expansion. Inflation has minimal impact on this segment with geopolitical discord driving security spending in Eastern Europe up by 5%-7% while other cloud spending has remained unchanged. The segment posted an EBIT margin of -15% due to significant increases in R&D, but still has a runway to expand margins to AWS FY21 levels of 30% or more. Continued expansion of these margins will drive robust FCF for Google, allowing them to continue to innovate and fund future growth initiatives internally.

Stock Repurchases

During 1Q22 earnings, Google announced that its board of directors authorized $70 billion in share repurchases. During FY21, Google authorized a total of $50 billion in stock repurchases, more than any other public company except for Apple. Google has a demonstrated record of share repurchases dating back to 2019, where they authorized $25 billion in buybacks. Barring any significant setbacks, Google seems to be committed to rewarding shareholders via buybacks for the foreseeable future.

Waymo

Google has a subsidiary that is exclusively committed to creating world-changing companies that could eventually become the next Google. One initiative of this subsidiary is Waymo, which was created in 2009 as Google’s self-driving car endeavor. Waymo could bring about revolutionary change by increasing road safety, decreasing fossil fuels, and lower transportation costs. Waymo has also formed multiple partnerships with automakers to integrate the technology into each automobile.

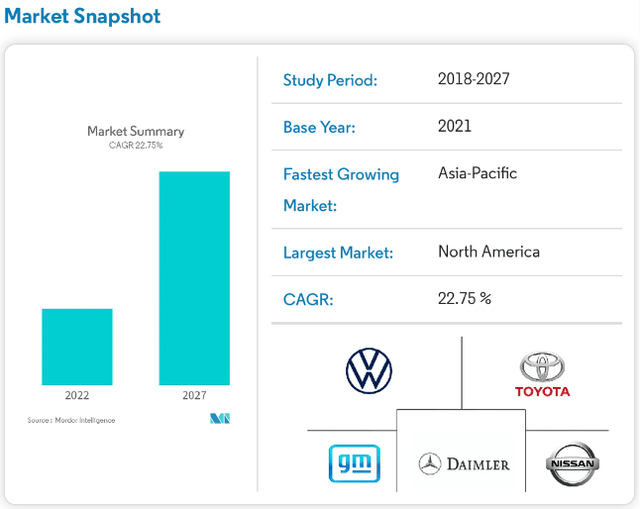

Waymo is just another reason that investors should buy GOOG stock. According to one market intelligence firm, the autonomous-vehicle market is expected to grow at a CAGR of 22.75% with the largest market being North America (see below). This past March, GOOG announced that it is expanding its autonomous vehicle test in San Francisco. They are making a fully electric Jaguar available to SF-area employees who want a driverless ride to work. In addition to ride-hailing, Waymo is working on expanding into trucking as well.

Autonomous Vehicle Market Forecast (Mordor Intelligence)

According to Waymo’s website, 70% of freight in the U.S. is sent by truck. In the past year, trucking companies have been impacted by the labor shortage. Fewer drivers mean fewer freight deliveries, which results in lower sales. Autonomous vehicles offer a solution to the labor shortage for trucking companies. Additionally, trucking companies will be tempted to shift to autonomous vehicles due to significant reductions in payroll expenses. Google has already formed Waymo partnerships with several trucking companies, including J.B. Hunt. If enough trucking companies were to implement Waymo, the labor shortage issue would become mitigated, labor costs would be reduced, and delivery efficiency would improve.

Investment bank UBS projects the total value of the driverless market to be worth up to $2.8 trillion in 2030. They also forecast that Waymo will own 60% of the driverless vehicle market. Additionally, UBS forecasts that Waymo itself will be worth between $75 billion and $135 billion in revenues by 2030, which is 4x as much as the YouTube segment alone.

Discounted Cash Flow Model

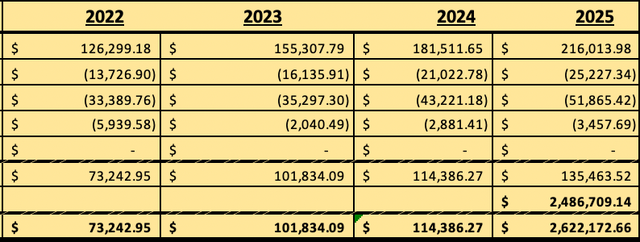

Revenue Forecasts for DCF (Excel)

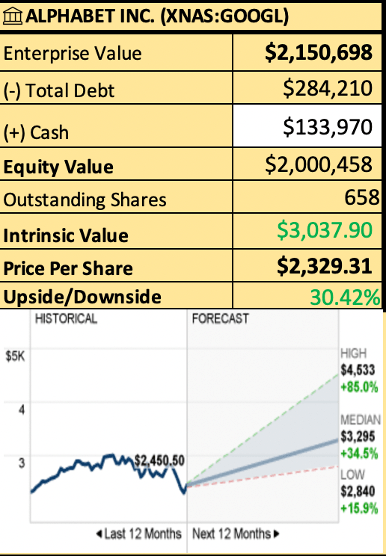

For my discounted cash flow model, I used analyst consensus estimates for Adj. EBITDA in FY22 and FY23. I made assumptions of a 20% CAGR in revenue for FY24 and FY25 (see above). After inputting these assumptions into my DCF analysis, I arrived at an intrinsic value of $3037.90 per share (30.42% upside from current price of $2307.90). Regarding costs and expenses, I used the 3-year historical averages as a % of sales.

Over the past three years, GOOGL’s average cost of revenue was 32.46% of sales. Their 3-year average of operating expenses was 29.84% of sales. Non-operating expenses were 44% of sales. Capital expenditures were 13% of sales. And finally, changes in net working capital were 5% of sales. Regarding terminal value, I used the 10 Yr Treasury Note as the perpetuity growth rate. After placing these assumptions into my DCF model, I arrived at the following cash flows for FY22 through FY25:

Free Cash Flow Forecast (Excel)

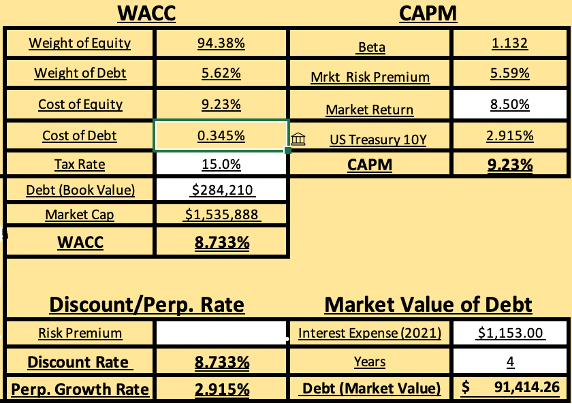

For my discount rate, I calculated GOOGL’s WAAC to be 8.73% using their current market capitalization and current market value of debt (see below). To calculate GOOGL’s Cost of Equity, I arrived at a market risk premium of 5.59% for their cost of equity by taking the difference between an expected market return of 8.5% and risk-free rate of 2.91% (US Treasury 10Y). To calculate the market value of debt, I used the interest expense from 2021, total debt (book value) from YE21, and a period of 4 years.

WACC Calculation (Excel)

After applying a WACC of 8.73% to my forecasted future cash flows for MSFT, I arrived at an intrinsic value of $3037.90 per share (pictured below). This represents 30.42% upside from the current share price of $2329.31. My price target falls under the median of Wall Street’s 12-month price targets, which vary from $2840 to $4533 per share.

Intrinsic/Enterprise Value (Excel)

Investment Risks

There are several risks to consider before investing in GOOGL. Despite the healthy state of the consumer balance sheet, the risk of recession is steadily increasing and may come sooner rather than later. Bloomberg sees the current probability of recession at 25%, while Goldman Sachs is even more pessimistic as high as 35%. This is very much a possibility soon given the geopolitical turmoil, inflationary environment, high oil prices, and potential corporate tax hikes. Given the healthy state of the consumer balance sheet, the next recession will hopefully be not as bad as the dot com bubble or sub-prime mortgage crisis.

Because of Google’s wide array of product offerings, the company is exposed to broader competitive pressure. As always, Google will continue to dominate the search engine market, driving robust advertising revenue growth. However, the company operates within the highly competitive cloud and subscription streaming markets. The Cloud market is currently dominated by Amazon and Microsoft, making up 50% of total market share. Additionally, YouTube revenue could suffer given the plethora of different competitors in the subscription streaming space. These competitive pressures could cause Google to lose valuable market share in their YouTube and Cloud segments.

Closing Remarks

Google is the dominant player in the search engine industry, allowing them to have a dependable revenue stream in advertising. Despite the signs of YouTube’s advertising weakness, there is still a strong uptick in other areas of the segment such as user engagement and subscriber growth. Google also has several moonshots in their product pipeline that could lead to exponential returns. Waymo is well-positioned to dominate the autonomous vehicle market, offering google an enormous business opportunity. Long GOOGL.

[ad_2]

Source link

More Stories

Car Rental Tips Before Planning For a Vacation Trip

Why Is It A Good Idea To Hire A Limousine?

Looking To Become An Uber Driver? Here’s Why You Should Use A PCO Rental Service