[ad_1]

The introduction of the Ford Bronco in June 2021 marked the

1st time in decades that a design has been positioned to contend

straight with the iconic Wrangler. S&P World-wide Mobility new

auto registration facts show Bronco has without a doubt conquested

Wrangler owners (extra than any other product), but the Bronco lags

driving the Jeep on many metrics, together with share of segment.

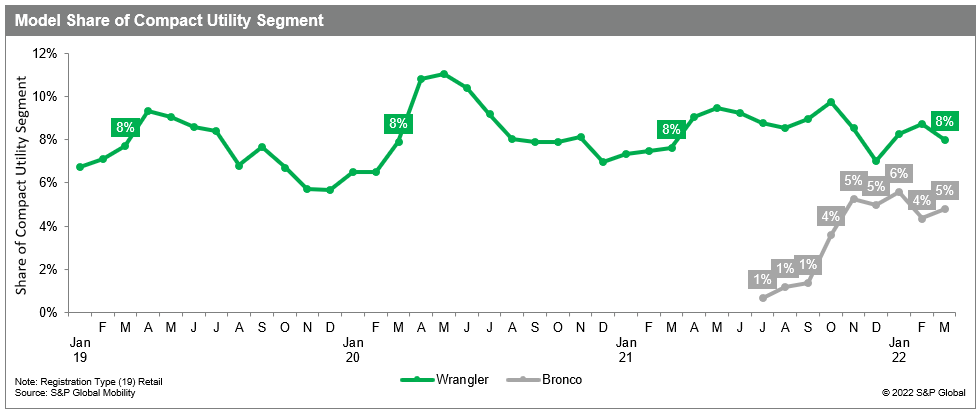

Market place share info demonstrate that Bronco share of the Compact Utility

Phase has climbed intermittently to 6%, but Wrangler carries on to

account for 7-9% of the phase, suggesting Bronco has not

materially damage Wrangler. Instead, S&P World Mobility loyalty

details counsel the CR-V, Cherokee and Rogue all have ceded share

considering the fact that the Bronco launch.

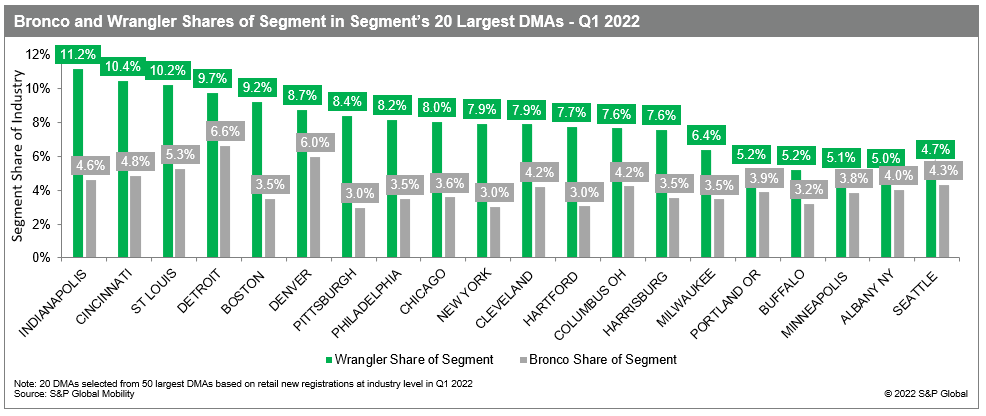

At the DMA amount, Wrangler carries on to out-execute Bronco in

every one particular of the Compact Utility Segment’s 20 biggest DMAs,

while the gap is little in Minneapolis, Albany (NY) and

Seattle.

Though the two models’ shopper profiles are related, there are

slight variances. Bronco clients skew a little young, have

marginally bigger incomes, and are much more possible to be male when

compared to Wrangler buyers. The Bronco shopper also is more

very likely to be of Western European descent, and considerably less possible to be

African American, Asian, or Hispanic, when matched with the

Wrangler proprietor.

The Bronco customer also is virtually two times as probable to have a pickup in

the garage, but much less most likely to have an SUV or CUV.

Pretty much 50 percent of Bronco purchasers have a Ford in the garage,

when a bit significantly less than 4 of every ten Wrangler customers personal a

Jeep. The Bronco final result might be thanks in element to its recent

introduction all-new incremental products tend to initially attractiveness

to brand loyalists who are mindful of the new model, have anxiously

been anticipating its arrival, and are amid the initially to pay a visit to

showrooms to see it.

Relating to the Bronco acquisition alone, S&P World-wide Mobility

details examine this from various views.

Incentives are way down, and approaching zero, provided the

exceptionally reduced stock stages, even though vendor plenty have a couple of

more autos than they did again in the slide.

Wrangler prospects are 8 moments far more probable to lease than Bronco

buyers, most probably pushed by pretty aggressive Wrangler lease

payments. In truth, these reduced lease payments are captivating to

relatively significant credit history consumers, far more very well off than Bronco

lessees. In contrast, Bronco buyers normally have better credit score

scores than Wrangler purchasers.

These bigger-credit Bronco customers in change are equipped to borrow

cash at decreased interest rates than their Wrangler counterparts.

Personal loan regular monthly payments for both of those types, even though, skew higher than section

average, due in component to higher transaction price ranges when compared to

other compact utilities.

Lastly, Wrangler consumers commonly have a larger personal loan-to-value

(LTV) ratio than Bronco prospective buyers (and the phase all round), resulting

from Wrangler buyers’ lessen credit score-worthiness.

Model loyalty of return-to-current market Bronco households is large

(continuously about 60%), but, once again, this is pushed in part by the

actuality that it was a short while ago released this metric ought to decrease

around time. In contrast, Wrangler brand loyalty is in the 44-47%

assortment and down below segment normal.

With the Bronco launch previous summer time, Wrangler’s

conquest/defection ratio (with the market) started to decrease this

metric averaged 1.35 from January 2020 as a result of May perhaps 2021 but dropped

to 1.11 from June 2021 via March 2022. In each of the 9

months that the Bronco has been readily available (not including June, when

action was minimum), much more Wrangler households have defected to

the Bronco than have households with any other car in the

garage. And the variety of Wrangler households that defect to the

Bronco (as a per cent of whole Wrangler defections) has risen to

document highs of 9% and 10% in January and February 2022,

respectively, and 9% once again in March 2022.

Though these two styles have related technical specs and consumer

profiles, there is 1 key change in between them the Wrangler

has been on U.S. roadways, in a person version or another, given that WWII,

even though the Bronco is only in its ninth thirty day period on the sector (for

which S&P World wide Mobility has info). The functionality of new

versions on several metrics is various from their effectiveness just after

they have come to be set up, so we can expect to see variations in

Bronco metrics shifting ahead.

To obtain the comprehensive report, click

in this article

This posting was posted by S&P World-wide Mobility and not by S&P World-wide Scores, which is a individually managed division of S&P World.

[ad_2]

Source backlink

More Stories

Electrical Vehicle Charging

Electric Vehicles Pose Risks for Emergency Responders

Load Manager For Large Vehicles